#Abstract of judgment texas trial#

A trial date will be set by the court staff at the request of the plaintiff or the defendant. The defendant also has the right to ask written questions to the plaintiff and ask that the plaintiff send documents. If this happens to you, it is important to answer the questions and send the documents that are asked for. The defendant may also get papers asking him to answer questions or send documents.

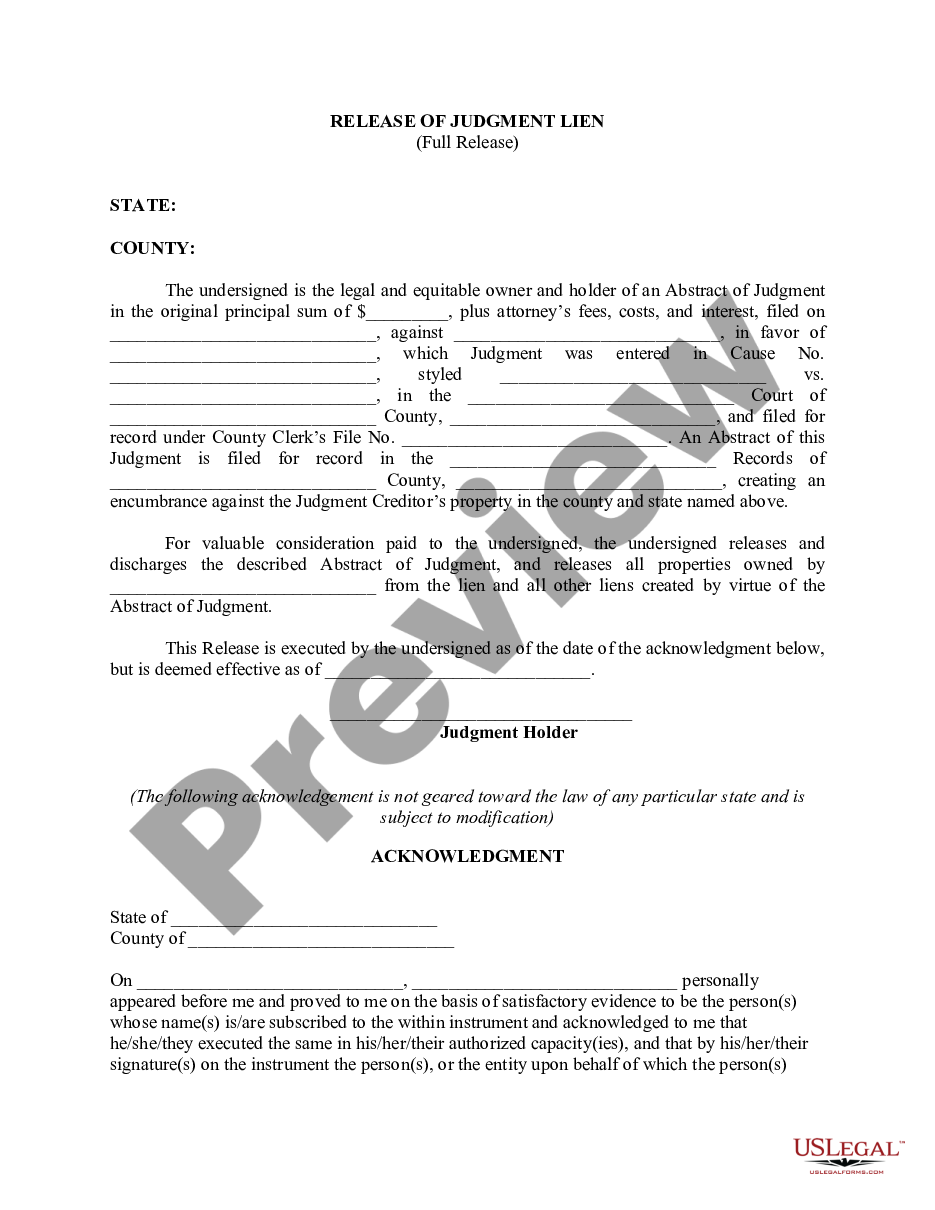

The front page of the papers tells the defendant that he (the word “he” also means she) has been sued and that he has to answer the lawsuit by a certain time. Usually, the papers are hand delivered to the person’s house. The person or company that files papers at the courthouse first is called a "plaintiff." The person they have sued is called a "defendant." The plaintiff has to pay a fee to have a copy of the lawsuit papers sent to the defendant. To take a person to court, the creditor has to file papers (a lawsuit) at the courthouse saying that the person owes money and has not paid. Be extremely careful! Paying off the credit card will stop the phone calls from bill collectors, but it just replaces one debt with another, and, if you are unable to pay the home equity loan, you could lose your house. Many lenders will try to talk people with large credit card debts into getting a home equity loan to pay off the credit cards. Home equity loans are secured by the debtor’s equity in his or her home. Important: Credit card debt is usually unsecured. Instead, the creditor must try to collect the debt from the debtor. If a credit card bill is not paid on time, the creditor cannot take the items bought with the card. For example, a credit card purchase is an unsecured debt. Mortgages, home equity loans, and most car loans are examples of secured debt.Īn unsecured debt is one that has no collateral. A release of lien is a document that confirms that the loan has been fully paid and that the lender no longer has a right of repossession. And, after the last payment is made, the person gets a release of lien. If a person makes every payment on time, the lender cannot take back the collateral. When a lender takes collateral for non-payment, this is called repossession.Īnything that is used for collateral on a secured debt can be repossessed. For example, if a person does not pay on a car loan, the lender can take the car. The debtor agrees with the lender (creditor) that if the debtor does not pay on time, the lender can take and sell the item that is collateral. Some common types of collateral are cars, homes, or appliances. The property that secures a debt is called collateral. A person or business that is waiting to be paid because he offered you credit is called a creditor.Ī secured debt is secured by property. A person or business that lends money is called a lender.

0 kommentar(er)

0 kommentar(er)